Steps to File Claim on Car Insurance

13 Jun, 2022

13 Jun, 2022

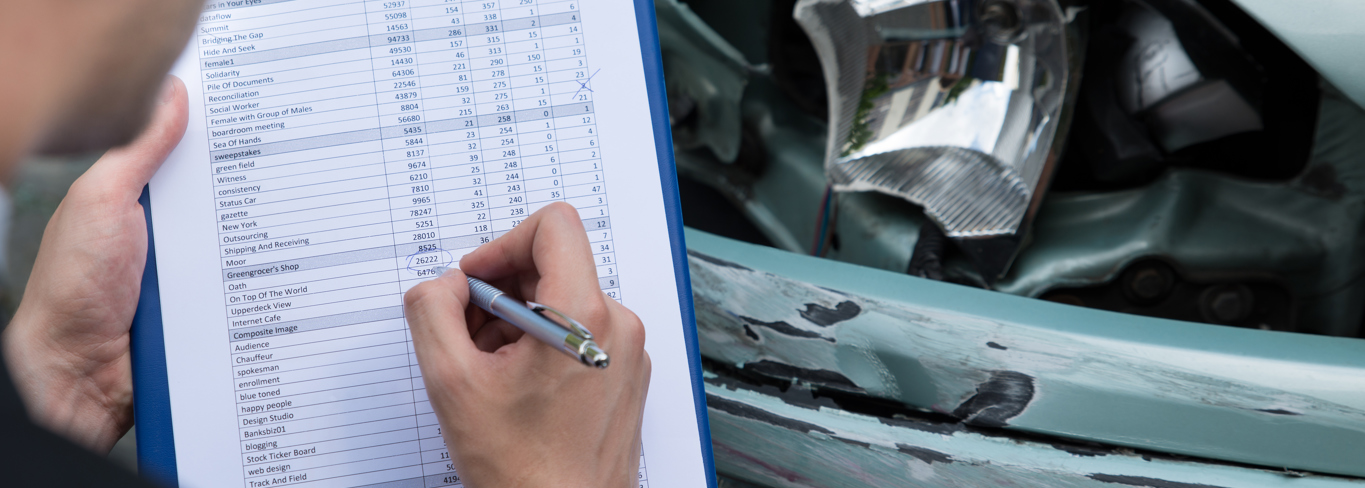

Everything you need to know about filing a claim on car insurance in Dubai as well as some helpful tips that can make the whole process smooth. Click here! In this article, we will explain everything you need to know about filing a claim on car insurance in Dubai as well as some helpful tips that can make the whole process smooth.

When should a car insurance claim be filed?

After the accident, the quicker you file for a claim the better. Otherwise, for generally a car insurance policy or third-party car insurance, the claims should be filed within a year from the date of the mishap. It is recommended you check this with your insurance company beforehand.

That said, the following are the two broad categories of events when you can apply for car insurance claim settlement:

1. In case the damage is limited to the car

There are instances of stealing and vandalism where you are not in the car but the damage is done. This also applies when you are in a car accident but there is no physical harm to you or any other passengers.

2. In case of physical injuries in car accident

If there has been a road accident where you and/or your passengers got injured you are eligible to avail reimbursement as per your car insurance policy.

Do note that your car insurance may not be covering both of these cases. And even if it does, the process of claim settlement can be different.

That aside, let’s look into the typical steps of filing a car insurance claim.

Step 1: Get in touch with the police

It is mandatory to get a police report to claim reimbursement with your car insurance company in case of an accident. So, irrespective of the severity of the loss or injury, to make it official, inform the police of the mishap as soon as possible.

If you are in Dubai, you can use the Dubai police helpline number: #901, or the mobile app (iOS or Android) to file a complaint. Post your complaint to the police, your insurance company would work with their report to calculate the settlement amount.

Step 2: Inform your insurance company

An obvious point yet the most crucial in the process of car insurance claim settlement. After notifying the police, get in touch with your insurance provider or your insurance agent as soon as possible. They shall proactively guide you with the next steps and all the documentation required for the claim settlement.

It is important that you tell them about the event in as much detail as possible. Do not try to mislead or hide the information as it may backfire and you be left with more issues to handle.

Step 3: Record or take pics of the damage

In a road accident, the situation changes fast and your memory or even verbal description may not do justice to what actually happened. A reliable and straightforward solution to it is clicking pictures or shooting a video of the damage. You can use it as valid proof material to both the police and your car insurance company; and can be uploaded on their website or app as well.

All points aside, in case of bodily injury or similar, it is imperative that your first concern be yourself and the condition of those involved in the accident. So, while looking for car insurance to safeguard your vehicle online, do get an add-on personal accident cover in your car insurance.

Step 4: Revisit your car insurance policy

You must have gone through the brochure of the insurance when deciding to buy motor insurance online. So, in general, you must be aware of what is included in your car insurance policy. However, during the car insurance claim settlement process, it is important to revisit the documents of your car insurance policy again. This is to ensure that you meet all the requirements as per the wordings in the policy and the settlement amount is appropriate as well.

What are the documents required for claim settlement?

In the case of car insurance claim settlement in Dubai, typically, the following documents are required:

- Police Report (compulsory after an accident)

- Car or Vehicle Registration (Mulkiya) copy

- Valid UAE Driver’s License

- Emirates ID card

- Filled claim forms from both parties

Conclusion

We have no control over what could go wrong while driving. However, a car insurance policy ensures us of saving significant monetary loss. If not beforehand, then one would certainly appreciate the real value of having the right car insurance after a mishap. But for the lesson to not be too costly, it’s mandatory to buy car insurance as soon as you get a car in the UAE. And considering every type of mishap, experts advise taking a comprehensive car insurance policy over third-party car insurance.

Elevate Your Car Coverage to the Next Level!

Congratulations on taking the first step towards securing your car!

Now, imagine having even greater peace of mind with our Comprehensive Car Insurance plan.

Enjoy enhanced coverage, wider scope, and ultimate protection for your car.

Need more help?

Buy Now

Buy Now Online Plans

Online Plans