Credit insurance one policy multiple benefits

09 يونيو, 2020

09 يونيو, 2020

Insurance lends positivity & offers artillery for growth to business and the society. And, no product in the insurance marketplace epitomizes this statement more than Trade Credit Insurance or Credit Insurance as it is popularly called. Credit Insurance finds its roots in the early 20th century in Western Europe between the two world wars. And since then it has evolved not only as an Insurance product, but also as a brilliant business tool which is being used by exporters and other businesses to their advantage to foster business expansion and growth, by transferring uncertainties of credit default to an insurance mediums.

According to recent research results, more than 45% of business sales transactions (B2B or business to business) are affected on open credit terms. Another survey suggests that one out of every ten invoice remains unpaid and gets into the bad debt column of the accounting books. Business thrives on credit and as a seller, you cannot avoid building up your book debts, the only thing that you can do or should do is to protect yourselves from the debts turning “bad” so that you do not get into a major cash flow problem, resulting in your own business becoming a failure.

Credit Insurance is not the only risk management solution against non – payment of trade debts. There are other conventional methods including Letters of Credit and creating bad debt reserves. A Letter of Credit or LC as it is commonly known is a Bank’s guarantee that the invoice will be paid in full. However, this is costly and sometimes strangles the buyer by tying up a portion of the working capital. Creation of bad debt reserves helps in mitigating impact of smaller failures, but cannot absorb large and catastrophic losses. A Trade Credit Insurance scores above these methods in being more holistic and cost effective.

WHAT IS CREDIT INSURANCE?

Credit Insurance protects you from the ill effects of bad debts which can arise out of and due to payment defaults by your customers. This insurance will help you recover the unpaid invoices as a result of insolvency of your buyers or due to political risks or even protracted default. Thus, it helps in mitigating credit risks.

As a seller, you cannot avoid selling on credit, or else, you will be losing a major pie of the available market-space. And as you sell on credit, you start assuming the risk of default. More-so, more often than not, you would be dealing with few key customers who would be taking up a major share of your turnover. Sometimes, you would be even unaware of the creditworthiness of your customers. And if you are too risk-averse, and have inhibitions in taking credit risk, it would be difficult for you to expand your horizons. Credit Insurance is the perfect tool that you need to “Stop worrying & Start expanding”. If you have receivables in your balance sheet, there is always a potential risk and if there is a potential risk, managing it is the need of the hour.

HOW DOES CREDIT INSURANCE WORK?

- As per Euler Hermes’s Economic Outlook Report, 1 out of 4 companies were paid after 88 days in 2016.

- The same report suggests that Insolvencies will grow by more than 1% in 2018

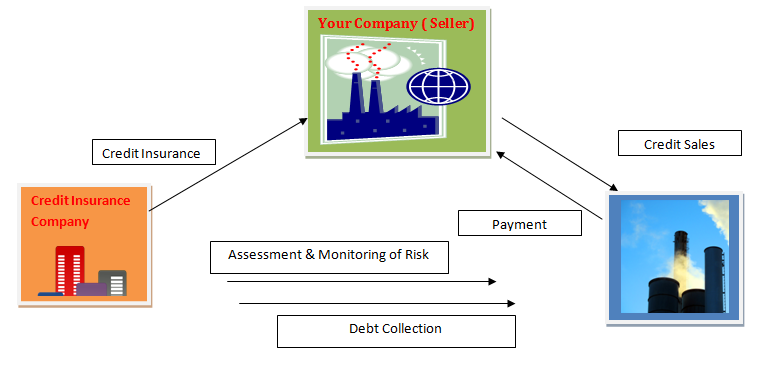

The above diagram schematically represents the position and role of the major stakeholders in Credit insurance. Now, let us briefly see how it works in the real life scenario.

- At the onset, the Credit Insurer will ask you to fill up a questionnaire. You will need to declare the names of your customers.

- The insurer will then study your customers and assess their creditworthiness.

- They will then assign a Credit Limit against each of your buyers based on their financial position and stability.

- The insurance policy will be made effective on your instruction. Needless to say, the premium needs to be paid.

- The credit insurer will continuously monitor the buyers and can provide inputs if any change is observed.

- The insurer can give you access to do the study yourself through their online portal.

- If you want to start a new relationship, you can assess their creditworthiness through this tool.

- The insurer can reject or accept this new buyer in their accepted list.

- If a customer defaults in payment, the credit insurer will try to recover the payment from the defaulting buyer. Payment failures can happen due to Political reasons, insolvency or protracted default.

- If recovery is not possible, the insurer will indemnify you by paying the claim.

- Since your receivables are now insured, you can expand your business and extend credit terms without worry.

- Your banks will now be more willing to extend working capital finance at lower costs by scrutinising your receivables

- You will have more access to market knowledge and will be a more informed seller.

- You can reduce your bad debt provision and also do away with costly letter of credits

- Finally, your balance sheet will be protected as the insurer will indemnify losses due to unpaid invoices.

Elevate Your Car Coverage to the Next Level!

Congratulations on taking the first step towards securing your car!

Now, imagine having even greater peace of mind with our Comprehensive Car Insurance plan.

Enjoy enhanced coverage, wider scope, and ultimate protection for your car.

Need more help?

خطط عبر الإنترنت

خطط عبر الإنترنت