UAE Value Added Tax

20 Sep, 2017

20 Sep, 2017

UAE Value Added Tax. Value Added Tax (or VAT) is an indirect tax. Occasionally you might also see it referred to as a type of general consumption tax.

UAE Value Added Tax.

Value Added Tax (or VAT) is an indirect tax. Occasionally you might also see it referred to as a type of general consumption tax. In a country which has a VAT, it is imposed on most supplies of goods and services that are bought and sold.

VAT is one of the most common types of consumption tax found around the world. Over 150 countries have implemented VAT (or its equivalent, Goods and Services Tax), including all 29 European Union (EU) members, Canada, New Zealand, Australia, Singapore and Malaysia.

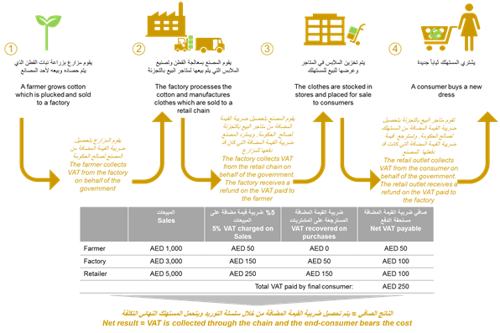

A business pays the government the tax that it collects from the customers while it may also receive a refund from the government on tax that it has paid to its suppliers. The net result is that tax receipts to government reflect the ‘value add’ throughout the supply chain. To explain how VAT works we have provided a simple, illustrative example below (based on a VAT rate of 5%).

VAT, as a general consumption tax, will apply to the majority of transactions of goods and services unless specifically exempted by law.

A business must register for VAT if their taxable supplies and imports exceed the mandatory registration threshold of AED 375,000.

Furthermore, a business may choose to register for VAT voluntarily if their supplies and imports are less than the mandatory registration threshold, but exceed the voluntary registration threshold of AED 187,500.

Similarly, a business may register voluntarily if their expenses exceed the voluntary registration threshold. This latter opportunity to register voluntarily is designed to enable start-up businesses with no turnover to register for VAT.

The UAE is the largest insurance market in the Gulf Cooperation Council (GCC) region, where motor and health policies value for 70 percent of the market

All insurance products other than Life will be costing more with VAT. Beginning 2018, purchase of Insurance products like Motor, Fire will cost 5% more. The life insurance products are currently in the excepted category.

Healthcare, education, and social services will also be exempt from VAT.

For more info and reference visit:

Buy Now

Buy Now Online Plans

Online Plans

HAVE A QUERY?